straight life policy formula

The straight life option pays a monthly annuity directly to the retiree for life. Each year you expense the same percentage.

Types Of Life Insurance Nerdwallet

On the death of the retiree the monthly payments.

. The goal of a permanent policy is to have life insurance in place for the rest of your life. Example of Straight Line Depreciation Method. A straight life insurance policy can also build cash.

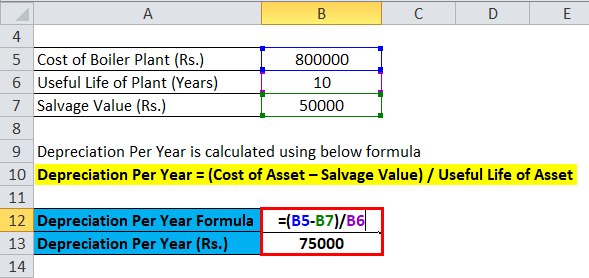

It is calculated based on the fiscal year which is defined by the fiscal. Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the. For example lets say a company.

This is expected to have 5 useful life years. Straight life is the simplest benefit option offered by APERS. Ad Life Insurance With SBLI Is The Best Way To Provide Financial Protection For Your Family.

Suppose we are given the following data and we need to calculate the depreciation using the straight-line method. Depreciation is calculated based on the fiscal years remaining. Cost of the asset.

For more information please see our. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. The salvage value of asset 1 is 5000 and of asset 2 is 10000.

You then find the year-one. Does a straight life annuity policy make sense. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases. In year one you multiply the cost or beginning book value by 50.

Calculate your annual straight life pension using your pension formula. The straight-line depreciation method spreads the cost evenly over the life of an asset. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy.

Every calculation for other payment options. Has purchased 2 assets costing 500000 and 700000. The depreciation rate is the annual depreciation amount total depreciable cost.

It is calculated based on the fiscal years remaining. The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets useful life. Straight Life Annuity.

Comparisons Trusted by 45000000. Allow Us To Guide You Through The Process And Help You Make The Right Decisions For You. The DDB rate of depreciation is twice the straight-line method.

Example Straight-line depreciation. In this case the machine has a straight-line depreciation rate of 16000 80000 20. If you select Fiscal in the Depreciation year field the straight line service life depreciation is used.

A straight life insurance policy often known as whole life insurance has a cash value account. Ad Find The Best Life Insurance Policy in 2022. Divide the product by 12 to calculate your monthly straight life benefit.

Straight Line Depreciation Accountingcoach

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

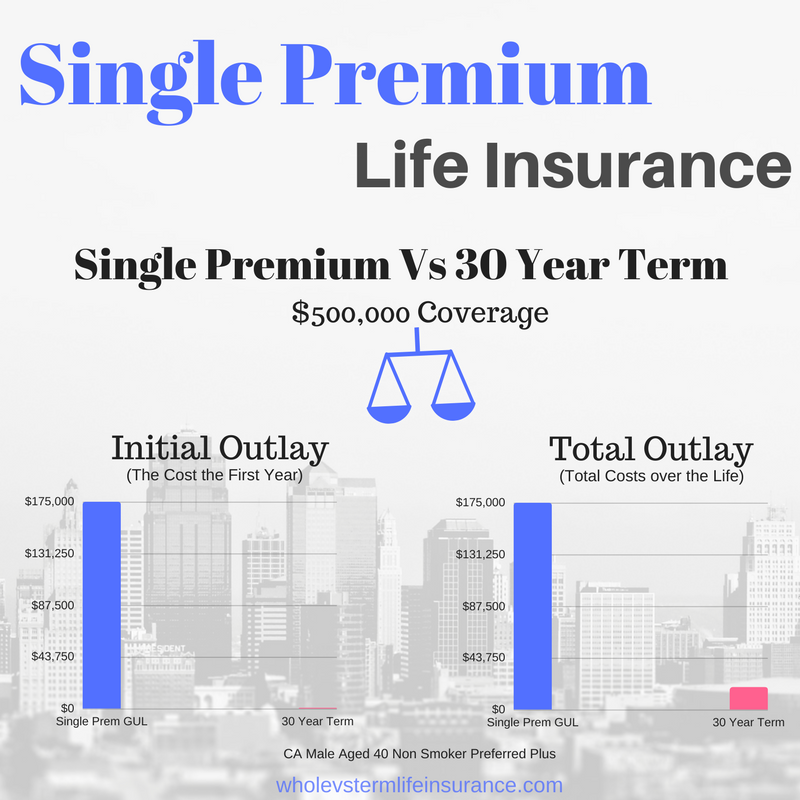

Single Premium Life Insurance Whole Vs Term Life

How To Calculate Premiums On A Whole Life Policy

How To Find The Slope Of An Equation Forms For Slope Video Lesson Transcript Study Com

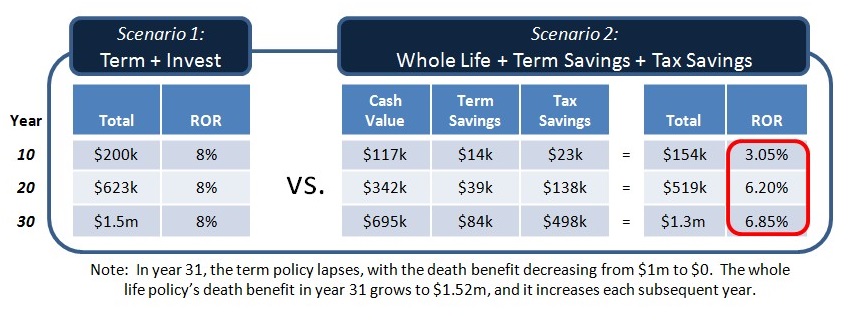

The Whole Story The True Rate Of Return Of Permanent Life Insurance Ultimate Estate Planner

What Is Single Premium Life Insurance The Pros And Cons Valuepenguin

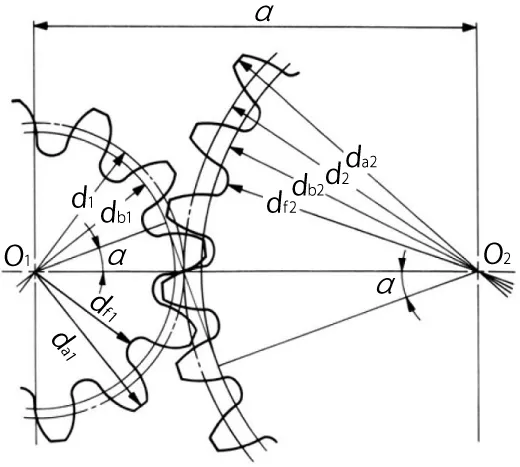

Calculation Of Gear Dimensions Khk

Straight Life Insurance New York Life

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Straight Line Depreciation Formula Calculator Excel Template

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Line Depreciation Financial Edge

How To Become A Straight A Student The Unconventional Strategies Real College Students Use To Score High While Studying Less Newport Cal 8601300480787 Amazon Com Books

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

Single Premium Life Insurance The Top 7 Pros Cons Of Spl

Formulas For Calculation Of Mathematical Reserve After T Years For Download Scientific Diagram

Level Ii Curriculum For New State Dot Transit Grant Managers In Administering Federal And State Transit Grants The National Academies Press