capital gains tax canada vs us

As a Canadian resident you are subject to tax on your worldwide income. Canadian investors are forced to pay capital gains tax on 50 of their realized capital gains.

What Is The Difference Between The Statutory And Effective Tax Rate

The tax rate for these transactions is identical to the individuals marginal tax.

. However only half 50 of a corporations capital gain needs to be included in the income. In our example you would have to. Any gains or losses from the sale of US.

The long-term capital gains tax rate is 15 for most taxpayers while the short-term capital gains tax rate is your. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Long-Term Capital Gains Taxes.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

Canada allows capital gains to be taxed at half of the normal tax rate and grants a reduced tax rate on dividends paid by Canadian but not. Property must also be included on your Canadian tax return. A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the.

From 1954 to 1967 the maximum capital gains tax rate was 25. In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. Capital gains are profits made from the sale of an investment like a stock or bond.

In Canada capital gains tax is applied to 50 of the profit you made. Capital gains are taxed at a lower rate than ordinary income. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in.

Capital gains tax canada vs us. And the tax rate depends on your income. In Canada 50 of the value of any capital gains is taxable.

In 1978 Congress eliminated. They are generally lower than short-term capital gains tax rates. This is known as.

The income is considered 50 of the capital gain. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Capital gains must be included in the declared taxable income of a corporation.

For example if you sold an. Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. The sale price minus your ACB is the capital gain that youll need to pay tax on.

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Short Term And Long Term Capital Gains Tax Rates By Income

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

How Capital Gains Tax Works In Canada Forbes Advisor Canada

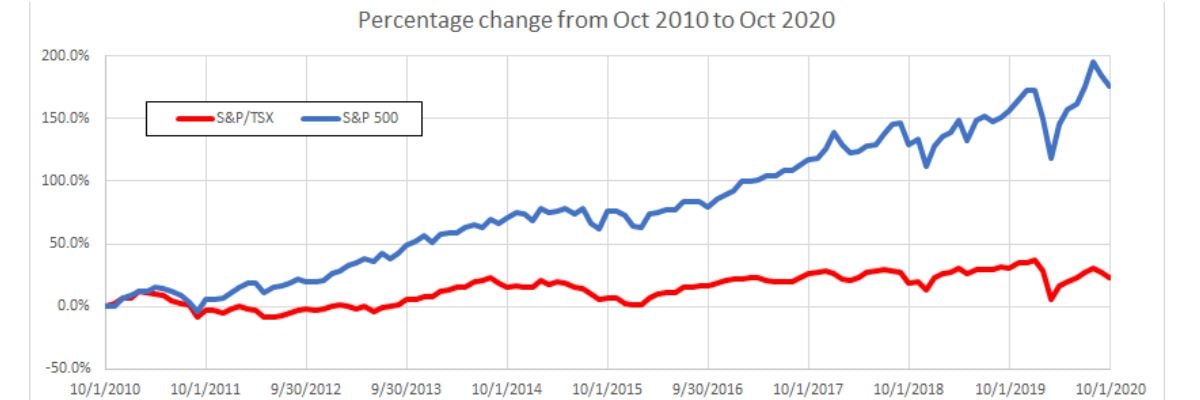

Canadian Stock Market Vs U S Where Are The Better Returns

U S Estate Tax For Canadians Manulife Investment Management

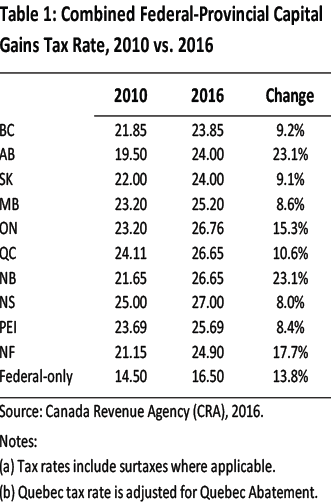

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax In Canada And The U S Tax 101 Youtube

How Capital Gains Tax Works In Canada Nerdwallet

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Short Term And Long Term Capital Gains Tax Rates By Income

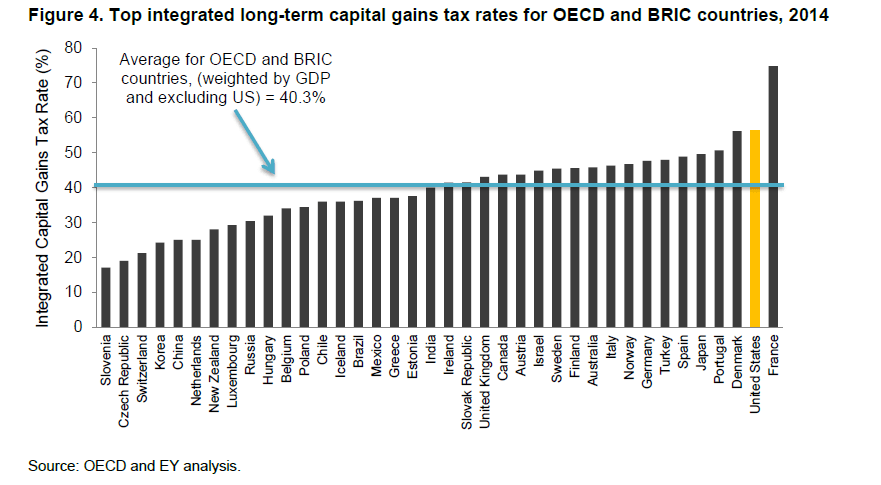

How Do Us Taxes Compare Internationally Tax Policy Center

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Investing Series How Does The Capital Gains Tax Work In Canada Save Spend Splurge

What Is The Difference Between The Statutory And Effective Tax Rate

Personal Income Taxes And The Capital Gains Tax Fraser Institute

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)